2025-07-24

2025-07-24

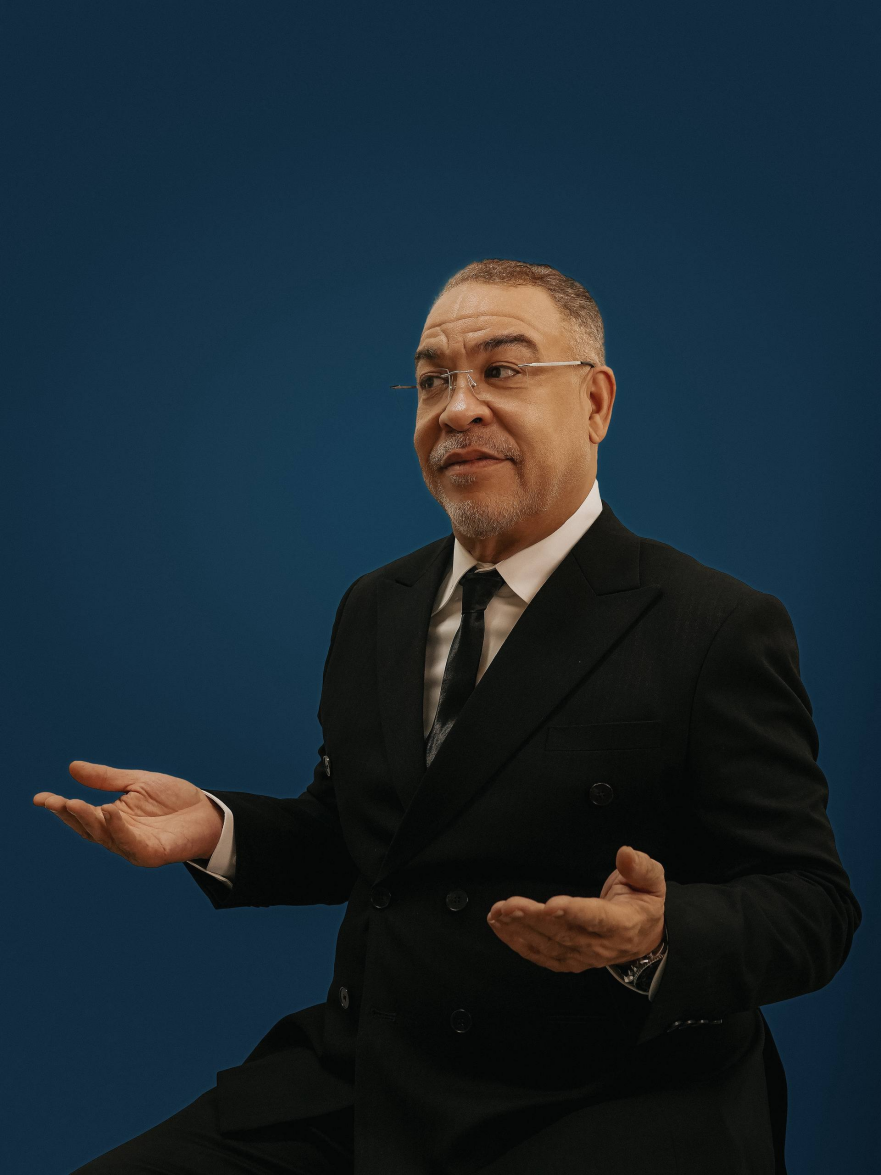

Herr Heun is currently the Chief Investment Officer of Victory Investing and is fully responsible for the company's global asset allocation, investment strategy formulation and portfolio risk control. As the core figure of the company's investment decision-making, he leads the investment team that manages huge assets, covering stocks, bonds, private equity and alternative assets.

He has more than ten years of deep experience in institutional trading, quantitative investment and cross-asset strategies. His expertise covers algorithmic trading, volatility arbitrage, market neutral structure and hedge fund strategies integrated with artificial intelligence. With his outstanding performance in ETF fund supervision and institutional-level asset management, Volker Heun has always maintained excellent investment performance.

2021–2025: The evolution of an AI-driven quantitative arbitrage framework

Between 2021 and 2025, Volker Heun led the development of a multi-layered AI-enhanced arbitrage system tailored for institutional investors. The platform (Closed-source AI) combines advanced machine learning and low-latency trading protocols, allowing the fund to remain resilient in the face of global market turmoil.

The system integrates:

*Hyper-Fast Execution (HFT) – designed for microsecond order routing and high-frequency signal processing to capture market inefficiencies.

*AI-driven statistical arbitrage – leveraging adaptive machine learning algorithms that exploit historical correlation matrices, price anomalies, and mean-reversion dynamics.

*Hedged Market Neutral Framework – a dynamic hedging model that ensures neutrality to market direction while targeting consistent alpha generation.

*Volatility Positioning – strategic exposure to implied volatility through derivatives and volatility indices during turbulent times.

In the turbulent macroeconomic environment of 2022-2023, Volker Heun's strategy performed well through intelligent signal detection and automatic risk-adjusted execution, and continued to outperform industry benchmarks.

With nearly 20 years of experience in the financial market, Volker Heun has profound attainments in macro strategy, multi-asset allocation, quantitative investment and risk management. He has worked in well-known institutions such as Victory Investing and Morgan Asset Management, and has accumulated rich experience in cross-cycle investment management, and can maintain a stable return performance in a complex market environment.

Volker Heun firmly believes in the investment philosophy of "long-term value + dynamic adjustment", emphasizes fundamentals as the core and risk control as the premise, and is committed to achieving sustainable capital appreciation for investors. He is good at capturing structural opportunities brought about by global economic and policy changes, especially in the equity market and major asset rotation.

Forward-looking innovation in 2025

Looking ahead to 2025, Volker Heun plans to expand the fund's innovative edge by improving algorithmic infrastructure, integrating blockchain-based asset strategies, and expanding the frontier ETF market and global macro hedge fund strategies. In addition, there will be a focus on strengthening market microstructure modeling, deep liquidity intelligence, and customized structured investment products.

The investment landscape is changing rapidly. We must focus on leveraging innovation and building a system that can evolve in sync with global markets.

Company name: Victory Investing

Contact: 559-374-2407

Email: info@victory-investing.com

Country: US/WY

Official website: https://www.victoryinvesting-llc.com